Restricted stock and performance stock awards typically provide immediate value at the time of vesting and can be an important part of your overall financial picture. Understanding what they are and how you might cover any associated taxes can help you make the most of the benefits they may provide.

Restricted Stock, Performance Stock Awards and Taxes: What To Know

When it comes to equity compensation, there are many different categories, all with their own rules and tax treatments. Here’s a breakdown of two common types: restricted stock and performance stock.

How Do Restricted Stock and Performance Stock Awards Work?

Restricted stock and performance stock awards give you an ownership stake in your company via shares of stock, subject to certain restrictions. Once your grant has vested and your company has released the shares to you, you can sell them at your discretion (outside of any company-imposed trading restrictions or blackout periods) or hold the shares as part of your portfolio.

When granted restricted stock or performance stock awards, you’ll first need to accept the grant. In most cases, restricted stock and performance stock awards are granted at no charge to the employee, although some companies may charge a nominal amount per share.

Restricted stock and performance stock awards are said to be “vested” when you own the shares free of restrictions—meaning you have the authority to sell, transfer or make other important decisions concerning the shares. Vesting conditions can be based on employment, the passage of time and/or the achievement of certain performance goals. The rate at which your stock vests—referred to as the “vesting schedule”—is described in your grant agreement.

In contrast to restricted stock and performance stock awards, restricted stock units and performance stock units are an unsecured promise to transfer either a specific number of shares of stock or the cash equivalent once vested. Unlike restricted stock and performance stock awards, restricted stock units and performance stock units do not represent actual ownership interests in the underlying company shares until vesting and delivery of shares.

Know the Types of Restricted Stock and Performance Stock Awards

Restricted Stock Unit (RSU)

A company’s commitment to give a specific number of shares of stock or cash equivalent to an employee at a future date, once vested. One RSU equates to a certain number of shares of company stock.

Restricted Stock Award (RSA)

A company’s award of a specific number of shares of stock to an employee, which are held in escrow and cannot be sold or transferred until vested.

Performance Stock Award (PSA)

A company’s award of a targeted number of shares of stock to an employee, which are held in escrow and cannot be sold or transferred until vested. The actual number of shares that vest will vary based on performance as measured against defined goals.

Performance Stock Unit (PSU)

A company’s commitment to give a targeted number of shares of stock or cash equivalent to an employee at a future date, once vested. The actual number of shares paid at vesting will vary based on performance as measured against the defined goals.

U.S. Tax Considerations

The following tax sections relate to U.S. taxpayers and provide general information. For those who are non-U.S. taxpayers, please refer to your local tax authority for information.

Before you take action on your shares, you’ll want to carefully consider the tax consequences. The information contained in this document is for informational purposes only. Tax treatment depends on a number of factors including, but not limited to, the type of award. State and local tax consequences may vary. For advice on your personal financial situation, please consult a tax advisor.

Taxes at Vest

For RSAs and PSAs, the value of your shares when they vest, less the amount you paid for the shares (if any), is treated as ordinary income for federal income tax purposes. For RSUs and PSUs, you are taxed as ordinary income on the value of the shares when they are delivered following vesting. For all award types, your employer should report this amount on Form W-2 or other applicable tax documents, and it will be subject to federal income tax.

For example, if you have 100 shares of restricted stock that vest when the stock price is $30 per share, and you did not pay for the shares, you’ll generally recognize ordinary income of $3,000 in the year the shares vest. The ordinary income you recognize upon vesting establishes your cost basis, which is important when you eventually sell, gift or otherwise dispose of the shares. If you make a Section 83(b) election (only available for RSAs and PSAs, as described below), you would be allowed to recognize income on the day you received the grant rather than the day of vesting, which may create a taxable event at that time. For RSUs and PSUs, if you are eligible to and do make a Section 83(i) election (described below), you would be allowed to defer the income inclusion to a later date instead of the vesting date. Note, however, that a Section 83(i) election is only available in limited circumstances.

Taxes at Sale

When you sell shares received from your vested stock awards, any capital gains or losses will be realized. To determine your gains, if any, you would generally use the stock price at sale minus the stock price at vest, multiplied by the number of shares sold. If you held the stock for more than a year after the vest date, the capital gains should be eligible to be treated as long-term capital gains for federal income tax purposes, which has historically been taxed at a lower rate. Any losses you incur are not taxable, and may even be deductible.

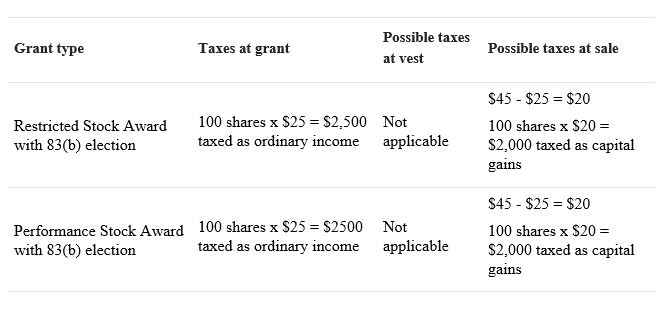

- Acceleration (Section 83(b) election): In some cases, for RSAs and PSAs, it is possible to move up the first tax trigger from the vest date to the grant date by filing a Section 83(b) election with the Internal Revenue Service (IRS). This must be done within 30 days of the grant. Please keep in mind that paying taxes at grant can be risky, therefore, you should consult with your tax advisor, as there are no allowances for refund or tax loss if your shares fail to vest or decrease in value. You should check with your company to see if it allows this type of election. Section 83(b) elections are not applicable to RSUs or PSUs.

- Deferral: In some cases, it is possible to defer the receipt of shares from an RSU or PSU grant. Even if a deferral election is made, employment taxes (Social Security and Medicare tax) will typically be due at vest. However, income taxes can usually be deferred until the shares are released to you. You should check with your company to see if it allows this type of election and consult with your tax advisor.

- Section 83(i) election: In some cases, it is possible to defer the first federal income tax trigger from the vest date to a later date by filing a Section 83(i) election with the IRS. This must be done within 30 days of the vest date. If the election is made, ordinary income is determined on the original vest date, but the income inclusion can be deferred to the earlier of: (1) the first date the underlying stock becomes transferrable, (2) the first date that the employee becomes an “excluded employee” as defined in the tax code (such as the CEO, CFO, and certain other highly compensated employees, among others), (3) the first date that the underlying stock becomes tradable on a stock exchange, (4) five years after the original vest date or (5) the date that the employee revokes the election. There are many other requirements and limitations on section 83(i) elections. You should check with your company to see if it allows this type of election and consult with your tax advisor.

Taxes at Dividends

Depending on the terms of the award, an employer may provide the payment of dividends or dividend equivalents (both referred to as dividends in this paragraph) on unvested restricted stock and performance stock awards. Any dividends received on your shares are typically considered income and are treated as such in the year they are received. If your grant includes dividend benefits before vesting, any dividends your company issues may be reported on your Form W-2 as wages and will be taxed as ordinary income. If you are not an employee of the company, your dividends may be reported on a 1099-NEC as non-employee compensation. If you make a Section 83(b) election (described above), your dividends may be reported on a 1099-DIV and taxed as dividends. RSUs and PSUs are typically not eligible to receive dividends, but may receive dividend equivalents.

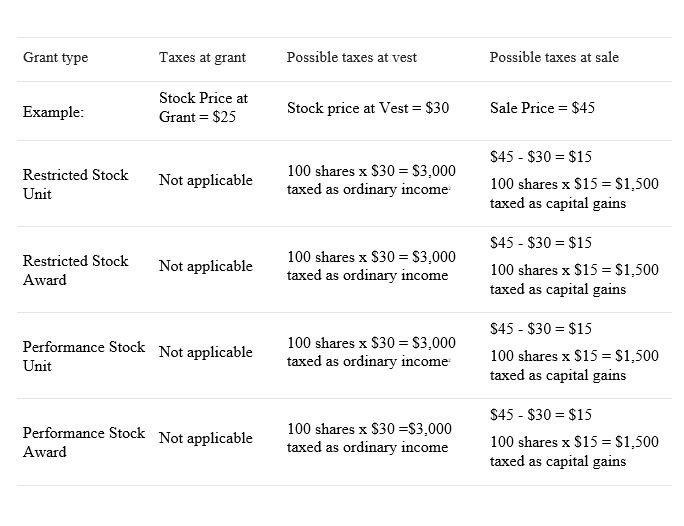

A Closer Look At Potential Tax Scenarios

Let’s take a look at the potential taxes for different types of restricted stock and performance stock. This hypothetical example assumes a grant of 100 shares or units of company stock issued at no cost to the employee, and no section 83(b) or 83(i) election.

Examples with 83(b) election

Tax treatment for each transaction depends on the type of restricted stock or performance stock you have been granted. Please keep in mind that these examples are hypothetical and for illustrative purposes only. For advice on your personal financial situation, please consult a tax advisor.

If you have elected to defer the receipt of the shares from your RSUs or PSUs, only employment taxes would be due at vest. Ordinary income tax would be due on the value of the shares at the time the shares are released to you.

Possible U.S. Tax Payment Methods

Typically, you will be taxed upon vest (unless you make a Section 83(b) election on your RSAs/PSAs or your employer allows you to defer receipt of your shares). There are several possible methods available to satisfy your tax withholding obligation.

You should check your plan documents to determine which withholding tax payment method(s) are available to you. Types of payment methods include:

Withhold shares

Your employer keeps a portion of the shares to pay taxes. The remaining shares (if any) are deposited to your account.

Same-day sale

All vested shares are immediately sold and a portion of the proceeds are used to pay taxes.

Sell-to-cover

Shares sufficient to cover the taxes are sold and the remaining shares (if any) are deposited to your account.

Cash transfer

You deposit cash in your account to pay withholding taxes.

The Bottom Line

If you receive restricted stock or performance stock awards from your employer, this can be a key part of your overall financial picture. So, it’s important to know how your shares work—and how they’re taxed. Professionals, like Financial Advisors and tax advisors, can help answer questions specific to your financial situation and goals.

Disclosures:

Banking products and services are provided by Morgan Stanley Private Bank, National Association, Member FDIC.

Morgan Stanley and its affiliates do not provide tax advice, and you always should consult your own tax advisor regarding your personal circumstances before taking any action that may have tax consequences.

Content and services available to non-US participants may be different than those available to US participants.

This is not an offer to sell or a solicitation of an offer to buy securities, products or services by any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. The products and services described herein are not marketed to residents outside of the United States and may not be available to persons or entities in foreign jurisdictions where prohibited.

The material provided by Morgan Stanley Smith Barney LLC, Morgan Stanley or any of their affiliates, or by a third party not affiliated with Morgan Stanley is for educational purposes only and is not an individualized recommendation. This information neither is, nor should be construed as, an offer or a solicitation of an offer, or a recommendation, to buy, sell, or hold any security, financial product, or instrument discussed herein, or to open a particular account or to engage in any specific investment strategy.

Employee stock plan solutions are offered by E*TRADE Financial Corporate Services, Inc., Solium Capital LLC, Solium Plan Managers LLC and Morgan Stanley Smith Barney LLC (“MSSB”), which are part of Morgan Stanley at Work.

Morgan Stanley at Work services and stock plan accounts are provided by wholly owned subsidiaries of Morgan Stanley.

Morgan Stanley at Work stock plan accounts were previously referred to as Shareworks, StockPlan Connect or E*TRADE stock plan accounts, as applicable.

In connection with stock plan solutions offered by Morgan Stanley at Work, securities products and services are offered by MSSB, Member SIPC.

E*TRADE from Morgan Stanley is a registered trademark of MSSB.

All entities are separate but affiliated subsidiaries of Morgan Stanley.

The laws, regulations, and rulings addressed by the products, services, and publications offered by Morgan Stanley and its affiliates are subject to various interpretations and frequent change. Morgan Stanley and its affiliates do not warrant these products, services, and publications against different interpretations or subsequent changes of laws, regulations, and rulings. Morgan Stanley and its affiliates do not provide legal, accounting, or tax advice. Always consult your own legal, accounting, and tax advisors.

Securities, investment advisory, commodity futures, options on futures and other non-deposit investment products and services are not insured by the FDIC, are not deposits or obligations of, or guaranteed by, Morgan Stanley Private Bank, National Association, and are subject to investment risk, including possible loss of the principal amount invested.

Securities products and investment advisory services offered by Morgan Stanley Smith Barney LLC, Member SIPC and a Registered Investment Adviser. Commodity futures and options on futures products and services offered by E*TRADE Futures LLC, Member NFA. Stock plan administration solutions and services offered by E*TRADE Financial Corporate Services, Inc., and are a part of Morgan Stanley at Work. Banking products and services provided by Morgan Stanley Private Bank, National Association, Member FDIC. All entities are separate but affiliated subsidiaries of Morgan Stanley. E*TRADE from Morgan Stanley and Morgan Stanley at Work are registered trademarks of Morgan Stanley.

© 2025 Morgan Stanley. All rights reserved.

CRC#4655319 (07/2025)