Morgan Stanley’s Investor Pulse poll highlights that while most investors hold an optimistic outlook—worries about their financial futures remain.

From record-breaking stock market returns to falling unemployment, the U.S. has no shortage of positive economic indicators, and the majority of investors say they feel confident about achieving both their short- and long-term goals, according to the latest "Morgan Stanley Investor Pulse Poll," which surveyed more than 1,200 investors age 25 to 75 with over $100,000 in assets. About one in four (29%)—or 36 million—U.S. households fall into this category.

Mostly Sunny, With Some Clouds

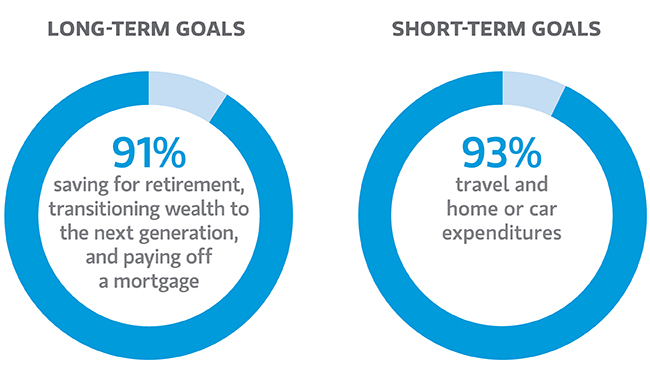

Investors are upbeat overall, with about 9 in 10 either "somewhat" or "very" happy with their financial situation today. Also, nearly 9 in 10 expect their portfolios to stay strong or improve in the coming year. Most (91%) believe they're solidly on track to realize long-term goals like:

Saving for retirement

Paying off a mortgage

Transferring their wealth to the next generation

Paying for a child's or grandchild's education

Nearly all (93%) are confident they'll achieve short-term goals like paying for travel, home and car expenditures.

Still, the investors polled aren't entirely carefree. More than two-thirds (67%) fear running out of money in their lifetime and 56% are uneasy about being able to maintain their standard of living.

Having enough money to manage retirement and unexpected medical costs are key concerns shared by more than half (56% and 52% respectively) of investors, and two-thirds (69%) are concerned about how the political climate will affect their finances.

Even Millennials polled say they are worried about retirement, with 72% of them concerned about having adequate funds, while 69% are uneasy about making that money last a lifetime.

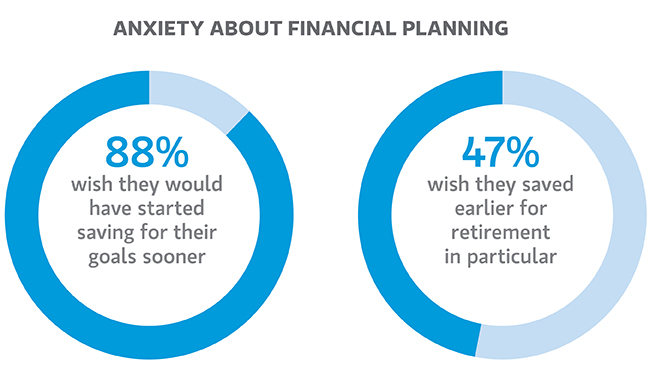

Of investors ages 45 and above, about 9 in 10 wish say they wished they had started saving for their goals earlier, with nearly half highlighting retirement in particular.

What can explain this apparent paradox between investor optimism and concern? In a nutshell: a lack of planning. Many investors admit they need help with finances, but fail to seek it.

The Advantage of Planning with a Financial Advisor

Roughly half of all investors working with a professional are looking for help with a written plan that includes budgeting, expenditures, and investments. Still, only one in three investors has a professionally prepared financial plan. Many apply a do-it-yourself approach (27%) or have no plan at all (36%).

Of the 36% of investors who do opt for a professionally prepared, goal-driven plan, 80% credit their financial advisors with their financial success.

Happier Investors Practice Good Financial Habits

Investors surveyed who reported being happiest overall also say they are less troubled by financial worries than their peers. They're less concerned about issues like having enough money for retirement or unexpected medical expenses.

What's their secret? They practice healthy financial habits like:

Working with a trusted professional familiar with your financial situation to develop a personalized plan driven by your goals can help build financial confidence in good times and bad. When those plans are combined with good financial habits, investors can move toward goals including buying a home, retirement, travel or paying for education. Talk with your Morgan Stanley Financial Advisor to discuss your year-end plans for 2020.