It's Easy to Fund Your Account

Direct Deposit

Set recurring deposits such as payroll,

and Social Security benefits

Incoming Wire

Contact your external financial institution

with wire details

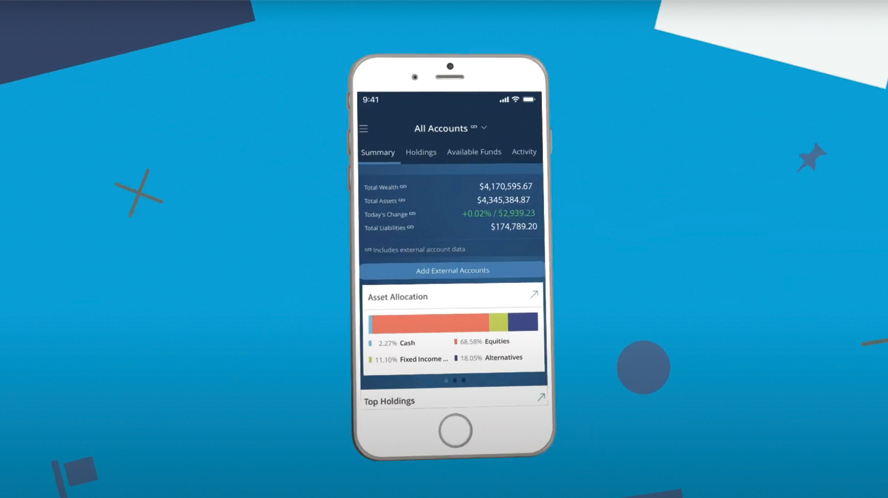

Mobile Check Deposit¹

Use the Morgan Stanley mobile app to

deposit checks from your device

1 The Morgan Stanley Mobile App is currently available for iPhone® and iPad® from the App StoreSM and AndroidTM on Google PlayTM. Standard messaging and data rates from your provider may apply. Subject to device connectivity.

2 Platinum CashPlus clients are eligible for the Annual Engagement Bonus (the “Bonus”) if they 1) are the Basic Card Member (primary account holder) of the Platinum Card® from American Express Exclusively for Morgan Stanley (the “Card”); or 2) spend at least $100,000 during the calendar year across Morgan Stanley Debit Cards associated with Platinum CashPlus Accounts in their Account-Linked Group (“ALG”) (the “Debit Card Use Threshold”).

Basic Card Members who apply for, and are approved for, the Card on or after September 18, 2025 will be eligible to receive a Bonus of $895. Basic Card Members with a Card Account renewal taking place through January 1, 2026, will be eligible to receive a Bonus of $695. Effective January 2, 2026, all Basic Card Members will be eligible for a Bonus of $895 after their next Card Account renewal, typically in the month following renewal.

Clients who qualify for the Bonus by meeting the Debit Card Use Threshold in 2025 are eligible to receive a Bonus of $695 in January 2026 and Clients who qualify for the Bonus in 2026 are eligible to receive a Bonus of $895 in January 2027.

Each ALG is eligible for one bonus per calendar year. Each client is only eligible for one bonus per calendar year. For more information regarding the tax implications of the Annual Engagement Bonus, including information about reporting and tax withholding, please refer to the CashPlus Account Disclosure Statement at https://www.morganstanley.com/wealth-disclosures/cashplusaccountdisclosurestatement.pdf.

The CashPlus Account is a brokerage account offered through Morgan Stanley Smith Barney LLC. Conditions and restrictions apply. Please refer to the CashPlus Account Disclosure Statement for further details at https://www.morganstanley.com/wealth-disclosures/cashplusaccountdisclosurestatement.pdf

The Morgan Stanley Debit Card is issued by Morgan Stanley Private Bank, National Association pursuant to a license from Mastercard International Incorporated. Mastercard and Maestro are registered trademarks of Mastercard International Incorporated. The third-party trademarks and service marks contained herein are the property of their respective owners. Investments and services offered through Morgan Stanley Smith Barney LLC, Member SIPC. Certain terms, conditions, restrictions, and exclusions apply. Please refer to the Morgan Stanley Debit Card Terms and Conditions at http://www.morganstanley.com/debitcardterms for additional information.

Electronic payments arrive to the payee within 1-2 business days, check payments arrive to the payee within 5 business days. Same-day and overnight payments are available for an additional fee within the available payment timeframes.

Send Money with Zelle® is available on the Morgan Stanley Mobile App for iPhone and Android and on Morgan Stanley Online. Enrollment is required and dollar and frequency limits may apply. Domestic fund transfers must be made from an eligible account at Morgan Stanley Smith Barney LLC (Morgan Stanley) to a U.S.-based account at another financial institution. Morgan Stanley maintains arrangements with JP Morgan Chase Bank, N.A. and UMB Bank, N.A. as NACHA-participating depository financial institutions for the processing of transfers with Zelle®. Data connection required, and message and data rates may apply, including those from your communications service provider. Transactions typically occur within minutes. To receive money in minutes, the recipient’s email address or U.S. mobile number must already be enrolled with Zelle®. See the Send Money with Zelle® terms for details.

Zelle® and the Zelle® related marks are wholly owned by Early Warning Services, LLC and are used herein under license. Morgan Stanley is not affiliated with Zelle®.

The Greenlight App and Debit Card is provided by Greenlight Financial Technologies, not Morgan Stanley or any of its affiliates. Morgan Stanley has entered into a referral partnership with Greenlight Technology Inc., the program manager for the Greenlight card and related mobile application. Greenlight charges a usage fee of $5.99 per month. Morgan Stanley will reimburse this $5.99 monthly fee to Greenlight on your behalf for one Greenlight account (up to five minors under 18 years old) as long as the following conditions are met:

i)Enroll in Greenlight using the enrollment link on Morgan Stanley Online or Mobile;

ii)Enroll in the Greenlight standard plan (currently $5.99/month (subject to change). Greenlight +Invest and Greenlight Max or any other current and future products are excluded from this offer; and

iii)Link a CashPlus Account for the Greenlight debit card funding.

Limited to one free Greenlight enrollment per CashPlus ALG.

This fee waiver only applies while you fund the Greenlight Debit Card from your CashPlus Account. Other Morgan Stanley accounts are not eligible for this offer and the Greenlight usage fee will no longer be waived if you close the associated CashPlus account or change the funding source on the Greenlight Debit Card to any other account type, including another Morgan Stanley non -CashPlus account type.

Please review the Greenlight terms and conditions and other applicable fees for the service at Greenlightcard.com before enrolling (such terms are subject to change at any time) Only the monthly usage fee is waived. You are responsible for all other fees associates with the use of the Greenlight service.

©2025 Greenlight Financial Technology, Inc. Patents Pending. The Greenlight card is issued by Community Federal Savings Bank, member FDIC, pursuant to license by Mastercard International. Message and data rates may apply.

Morgan Stanley Smith Barney LLC is a registered Broker/Dealer, Member SIPC, and not a bank. Where appropriate, Morgan Stanley Smith Barney LLC has entered into arrangements with banks and other third parties to assist in offering certain banking related products and services.

Investment, insurance and annuity products offered through Morgan Stanley Smith Barney LLC are: NOT FDIC INSURED | MAY LOSE VALUE | NOT BANK GUARANTEED | NOT A BANK DEPOSIT | NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

©2025 Morgan Stanley Smith Barney LLC. Member SIPC.

CRC#4918378 (11/2025)