Arlington, Virginia -

E*TRADE Advisor Services, a provider of integrated technology, custody, and practice management support for registered investment advisors (RIAs), today announced results from the most recent wave of its Independent Advisor Tracking study, which covers advisor views on the market, the industry, their business, and clients.

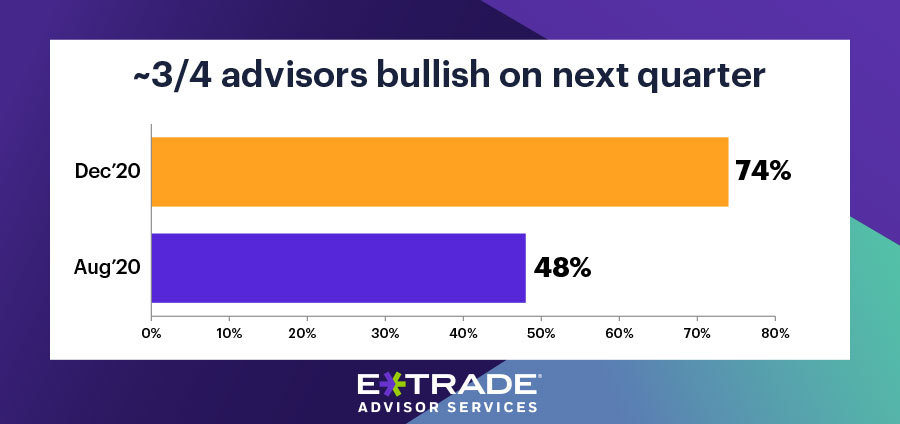

- Advisors are significantly more bullish heading into 2021. Nearly three out of four RIAs (74%) said they are bullish looking ahead to the first quarter—increasing 26 percentage points since August.

- Yet market volatility looms large. Advisors are actively managing market volatility (74%), followed by tax policy and regulation changes (55%), and interest rate risk (51%). Similarly, nearly three in four advisors (74%) think market volatility will stay the same or rise as a result of the election.

- New administration driving client calls. Advisors say clients are contacting them most about the new presidential administration (41%), followed by pandemic concerns (28%), and market volatility (19%).

- COVID uncertainty is the top business challenge in 2021. Nearly half of RIAs (46%) feel pandemic-related uncertainty is their number one business challenge heading into the New Year.

“We are about to close the chapter on a year that won’t be forgotten soon, marked by whipsawing markets, surging client inquiries, and an overnight transformation of advisors’ work environments,” said Matthew Wilson, President of E*TRADE Advisor Services. “Advisors are entering 2021 with eyes wide open—ready for volatility, the portfolio implications of a new presidential administration, and the persistently low interest rate environment. In times like these, emotional decision-making is certainly tempting among clients. This is where an advisor’s value proposition can truly shine. Advisors can offer a more measured view on long-term performance and strategic counsel specific to a client’s risk tolerance and time horizon.”

To learn more about E*TRADE Advisor Services, visit etrade.com/advisorservices.

For news and thought leadership from E*TRADE Advisor Services, follow us on LinkedIn.

About the Survey

This survey was conducted in-house from December 4 to December 10, 2020, among a convenience sample of 303 independent registered investment advisors.

About E*TRADE Financial and Important Notices

E*TRADE Advisor Services is a provider of integrated technology, custody, and practice management support for registered investment advisors (RIAs). E*TRADE Advisor Services is dedicated to helping RIAs realize their full potential and provide them the support they need to manage their practices and clients’ financial futures. More information is available at etrade.com/advisorservices.

E*TRADE Financial and its subsidiaries provide financial services including brokerage and banking products and services to retail customers. Bank products and services are offered by E*TRADE Bank, and RIA custody solutions are offered by E*TRADE Savings Bank doing business as “E*TRADE Advisor Services,” both of which are federal savings banks (Members FDIC). Securities products and services are offered by E*TRADE Securities LLC (Member FINRA/SIPC). Commodity futures and options on futures products and services are offered by E*TRADE Futures LLC (Member NFA). Managed Account Solutions are offered through E*TRADE Capital Management, LLC, a Registered Investment Adviser. More information is available at www.etrade.com.

E*TRADE Financial, E*TRADE, and the E*TRADE logo are trademarks or registered trademarks of E*TRADE Financial, LLC. ETFC-G

ETFC

© 2020 E*TRADE Financial, LLC, a business of Morgan Stanley. All rights reserved.

Referenced Data

When it comes to the market in the next three months, are you? |

||

|

August 2020 |

December 2020 |

Bullish |

48% |

74% |

Bearish |

52% |

26% |

What risks are you actively managing right now when it comes to client portfolios? Select all that apply. |

|

|

December 2020 |

Market volatility |

74% |

Tax policy and regulation changes |

55% |

Interest rates |

51% |

Political instability |

34% |

Inflation |

31% |

Recession |

29% |

Steepening yield curve |

17% |

Armed conflict, war, or terrorism |

5% |

Other |

4% |

None of these |

3% |

As a result of the presidential election, do you think market volatility will… |

|

|

December 2020 |

Greatly increase |

3% |

Somewhat increase |

25% |

Stay the same |

46% |

Somewhat decrease |

24% |

Greatly decrease |

2% |

When it comes to the market, what are your clients contacting you most about? |

|

|

December 2020 |

New presidential administration |

41% |

Coronavirus and other pandemic concerns |

28% |

Market volatility |

19% |

Recession |

3% |

Gridlock in Washington |

2% |

Softening job market |

1% |

Federal reserve monetary policy |

0% |

US trade tensions |

0% |

Economic weakness abroad |

0% |

Steepening yield curve |

0% |

Inflation |

0% |

Other, please specify: |

2% |

None |

3% |

What do you see as the biggest challenge to your business in 2021? |

|

|

December 2020 |

Covid-related uncertainty |

46% |

Technology improvements |

11% |

Client retention |

10% |

Company culture amid the virtual environment |

9% |

Succession planning |

7% |

Consolidation in the RIA industry |

7% |

None |

6% |

Other |

4% |

Contacts:

E*TRADE Media Relations

646-521-4418

mediainq@etrade.com