India is just getting started on what Morgan Stanley Research predicts will be a decade of record growth that could see its economy surpass Japan and Germany to become the world’s third-largest by 2027. In parallel, its stock market is on track to rank third in the world by the end of this decade. India has just come out of an election that will see incumbent Prime Minister Narendra Modi continue for a third term with his party leading a majority coalition in Parliament.

The market’s confidence in India’s growth picture has driven stock valuations higher, discounting expectations of future cash flows at lower rates of return. That said, investors may be missing other key factors that could help India run its longest and best bull market ever.

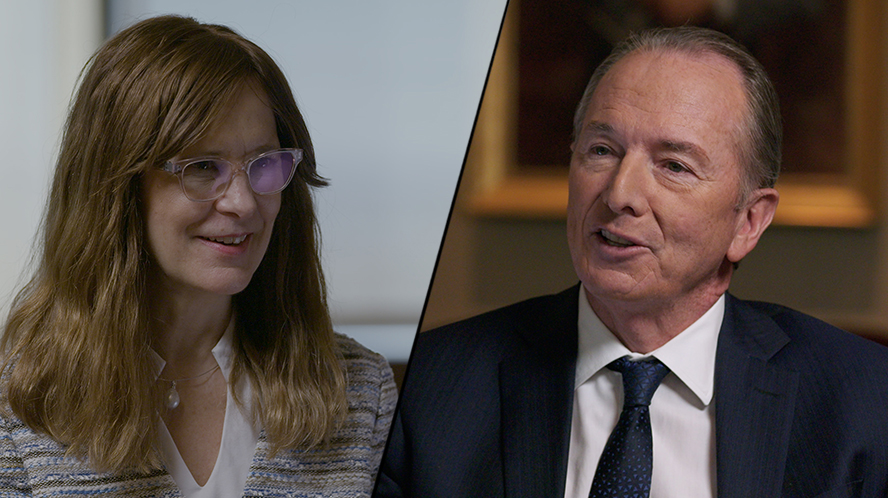

“The market may have largely priced in expectations for growth tied to leadership continuity, but we see a number of reasons, such as growing domestic investment in equities, improving social equity and a fast-evolving tech sector, that support earnings cycle growth and a corresponding lift to share prices,” says Ridham Desai, Morgan Stanley’s Chief Equity Strategist for India.

“These and other changes that could boost earnings 20% annually for the next five years still aren’t baked into share prices.”

India’s Bull Market Revs Up

Morgan Stanley expects India to drive one-fifth of global growth in the coming decade—an assumption that hinges on the country’s growing status as the back office and factory to the world, as well as a burgeoning consumer class empowered by a digital economy and a transition to green energy. India’s stock market reflects this narrative and has been on a steady rise, marking new highs. Investors’ confidence in future growth and moderating volatility, especially compared with other emerging markets equities, is driving up the price to earnings ratio.

“The ongoing bull market is the second-longest in India’s history. But while it has lasted 80% as long as the leading bull market, its cumulative return is less than a third of that period, so investors are questioning what could take stocks materially higher,” says Desai.

Desai and team think several key factors will help mark this bull market’s long run.

Private spending growth: India’s national deficit is declining, with the government counting on an economic shift toward private investment as a key driver of growth. Private spending, on weak footing for much of the last decade, has been showing signs of recovery on the heels of significant infrastructure investments by the government. Indeed, private sector projects in the works were growing 16.9% in December 2023, versus a decline of 4.2% in December 2019. “Our view is that in three years, India could move from primary deficit to balance,” says Desai. “The resulting widening gap between real economic growth and real interest rates would provide more support to share prices.”

India’s 401(k) moment: Currently, Indian households are less exposed to equities relative to other asset classes such as gold, but that is set to change. A 2015 change allowing retirement funds to invest in stocks is expected to create a demand cycle akin to what the U.S. experienced from 1980 to 2000, after a new law allowed employees to put some of their paycheck toward tax-deferred investment in stocks via retirement plans. “Domestic flows to U.S. stocks surged over two decades after that change. We see a similar boom in India coming, but expect it can last longer than 20 years given India’s much younger population and the low starting point of equity ownership,” says Desai.

Rising Social Equity: The brunt of price swings in basic goods and services is borne most heavily by the poor, and India is no different. But targeted measures by the central bank have helped to bring down inflation while declining female feticide, fertility rates and infant mortality rates are contributing to the upward mobility of the country’s poorest inhabitants. Those factors, along with our forecasts for 7.9% growth in gross domestic product for this year and 6.8% in 2025, should help diminish poverty further and feed a cycle of job creation, higher consumption and growth. “We think the continuing decline of poverty and rising worker and consumer class is one of the most underappreciated trends unfolding in India,” says Desai.

Other factors driving the bull run include: a burgeoning ecosystem of startups, in particular those addressing deep tech and agriculture needs; competition among Indian cities and states to be innovation and investment hubs; and a lending boom driven by digital credit enablement system that could give several million previously unbanked people access to financing.

What India’s Growth Means for Portfolios

“The most important thing to note in picking businesses for one’s portfolio is not the total addressable market but whether the business can sustain its competitive advantage,” says Desai. “There are several themes in India that fit this bill, given under-penetration and strong growth rates.”

The short list includes:

consumer-focused plays, such as travel, retail, luxury and healthcare services

large lenders and life insurance, among financials

green hydrogen, gas, power utilities, batteries and renewables

IT and non-IT professional services

industrials, including energy, mobility, defense and railways, as well as subsectors such as power plants, steel and cement

However, as Desai notes, India’s equity market still has plenty of risks. In addition to an unexpected election result that could stall growth, risks include geopolitics, low productivity in the farm sector, climate change and the bottlenecks created by strained bureaucratic and judiciary capacity.

“The bottom line is that macro stability is great news for share prices, and that is intricately linked to the continuity and strength of the government,” Desai says. “Polls indicate support for the consensus on India’s election outcome, which we think is already baked into share prices. On the whole, our view is that investors may not fully appreciate the longer-term factors for growth that could result from an election outcome in line with the market’s expectation.”

For deeper insights and analysis, ask your Morgan Stanley Representative or Financial Advisor for the full report, “This Bull Market’s Next Leg,” (April 14, 2024).